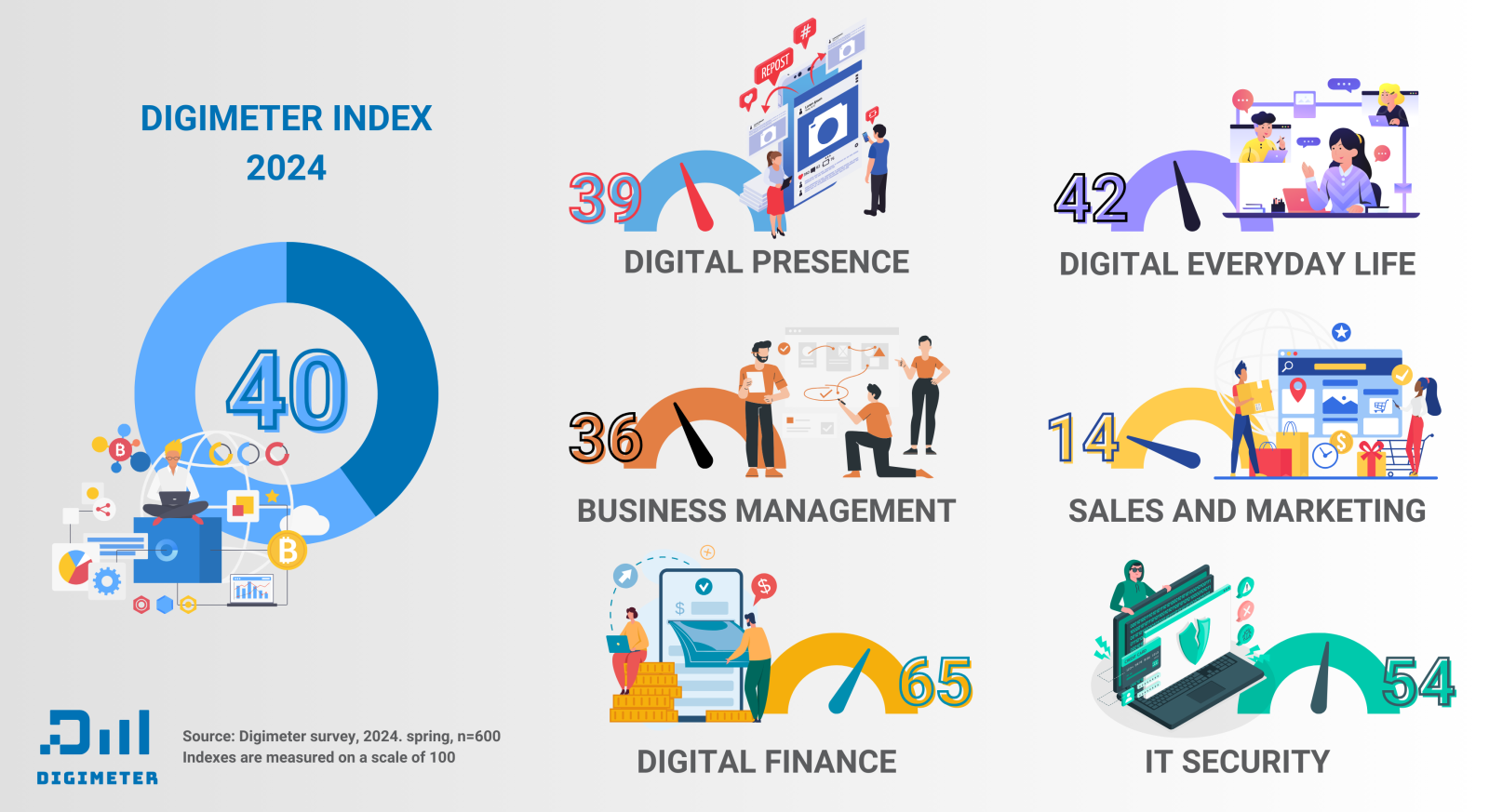

For the fourth time after 2020, 2021 and 2022, the Hungarian Digimeter measured the level of digitalisation of Hungarian small and medium-sized enterprises (SMEs). The main index score was 40 on a scale of 100 – the same score was 40 in 2020 and 2021 and 41 in 2022 – indicating that there is still no sign of any significant change in the overall level of digitalisation of Hungarian companies. While the financial area, which was the most advanced, has matured further, the other indices have not caught up, despite some improvement in several sub-areas.

Digimeter used the usual 50 questions in 6 areas (Digital Presence, Digital Everyday Life, Business Management, Sales and Marketing, Digital Finance, IT Security) to examine the digitalisation of companies in order to make the data comparable. The telephone survey was carried out in February 2024, and the multi-stratified sample of 600 firms is representative of Hungarian SMEs, with 5-249 employees and turnover between HUF 10 million and HUF 18 billion.

The gaps between the six sub-indices have widened further, with Digital Finance, which has always been the leader, making significant progress, while Sales and Marketing, which has always been the least developed, has seen a decline compared to previous measurements. At the level of the main indices and sub-indices, there is often a lack of movement, with significant improvements and declines in some places along a single factor.

- DIGITAL PRESENCE (39): the share of businesses with a website and/or webshop has decreased (72% of SMEs overall have a website – a step back from the high of 79% in 2022). However, after the 2022 decrease, the share of businesses with a Google Business Profile has increased significantly (34%), but the content is viewed much less frequently than in the 2022 survey. Nearly two-fifths (37%) of those with an account only check it occasionally, when needed.

- DIGITAL EVERYDAY LIFE (42): overall, the share of companies using a corporate server has decreased, but while 3 years ago half as many companies used a cloud-based version, the share of physical and cloud servers has now levelled out. There is an upward trend in the use of in-house developed mobile apps for companies, although the proportion remains low (9%). Three in ten (31%) companies have home office facilities available for employees at least one day a week, a significant increase compared to previous years. Overall, 12% of employees have access to a home office, with an above-average proportion of employees working (part-time) from home in firms in the Budapest and services sectors.

- BUSINESS MANAGEMENT (36): the share of people using ERP (35%) has recovered to 2021 levels after a spike in 2022, but slightly more people are using cloud or hybrid solutions than in previous years. The proportion of firms that regularly monitor data generated in the course of their operations for later use in decision-making has fallen, but the vast majority look at it at least occasionally. Digital data tracking would also be essential for AI-based developments. Excel or other spreadsheets remain the primary interface for data monitoring (69%), but paper summaries are used by only a quarter of companies (24%), a significant decrease compared to previous years.

- SALES AND MARKETING (14): the most underperforming sub-index in years has continued to deteriorate, with a score of only 14 in 2024. Half of SMEs do not advertise at all, two-fifths (42%) advertise online (mostly on a single channel) and 22% offline. The decline in the sub-index is mainly due to the lack of online sales: a fifth of SMEs (20%) have only a quote request form on their website and only one eighth (13%) have webshop. Seven out of ten (70%) do not sell online at all.

- DIGITAL FINANCE (65): this is the only sub-index that has shown a significant increase compared to the last survey – 61 then and 65 now. Nine out of ten (88%) businesses use an online service from their current account bank and six out of ten (61%) use a bank mobile app (also), the latter proportion showing a significant upward trend since 2021. Since 2020, the proportion of firms issuing and receiving electronic invoices has also been steadily increasing (2020: 44%; 2021: 48%; 2022: 51%; 2024: 67%).

- IT SECURITY (54): the 54 points of the sub-index represent no change compared to 2022. The larger a company (in terms of number of employees and turnover), the more seriously it takes this area. VPN usage (19%) has rebounded after a decline in 2022, but the proportion of firms that back up their data automatically has fallen back to 2024 after an earlier increase, with three in ten (29%) firms not backing up or not aware of it.

In the case of Digital Finance, development is also facilitated by various regulations of Hungarian authorities, while other areas are left to individual business decisions (e.g. social media presence, teleworking, online sales or use of mobile applications). It is therefore important that companies themselves recognise the competitive advantage of digitalisation.

Róbert Pintér, Associate Professor at Corvinus University and Digimeter's research director, also interpreted the results: "Our expectation at the end of 2022 that the unfolding crisis would strengthen efficiency-enhancing digitalisation turned out to be wishful thinking. Instead, companies have reverted to tried and tested solutions, typically non-digital. In Hungary, time seems to have come to a standstill for digitalisation in SMEs. With one or two exceptions (e.g. in the financial area, teleworking or Google Business Profile presence), we are seeing a return to the world we were used to before the age of the COVID-19. At the same time, this means that those who are now strengthening their digital presence can easily gain a competitive advantage over domestic players. They will also have a better chance of competing with increasingly active, more digitised foreign players in Hungary."

The main sponsor of the Digimeter research in 2024 is the Budapest Chamber of Commerce and Industry, whose general vice-president also summarised his thoughts on the topic. Dr. Ádám Balog said: “If a business wants to remain viable or, more importantly, successful today, it must think of digitalisation not as a goal to be achieved, but as a fundamental tool for everyday operations. For businesses, digitalisation is not an option, it is a way to survive and thrive. Digimeter's research is important not only because it gives an accurate picture of the status of digitalisation in SMEs, but also because it is an excellent example of how science, the scientific background, can help businesses in their everyday life and practical development.

A detailed report of the survey is available at https://digimeter.hu/kutatasok/ (in Hungarian)

About the Digimeter

Since 2020, the Digimeter research series has been examining the digitalisation of Hungarian SME sector twice a year. Once with a comprehensive large sample survey, once with a specific research using different methodologies. The results of the research are freely available in the form of press releases, podcasts, interviews, reports and scientific articles at https://digimeter.hu/.

Based on the measurements, any domestic company can get an idea of where it stands in digitalisation compared to its competitors. To this end, the My Digimeter system will be renewed by the end of 2024 and will be an artificial intelligence-based conversational system that will measure digital readiness levels in a company-specific way.

In 2024, the Digimeter will become an association to become as widely known as possible. The Digimeter Association is open to individuals or companies who can accept and support the central objective of helping SMEs to digitalise.

The Digimeter project is financed by sponsors, with the Budapest Chamber of Commerce and Industry as the main sponsor in 2024, and SimplePay by OTP Mobil and Shoptet as featured sponsors. Media partner is HVG.

Press contact: Róbert Pintér, Digiméter project, robert.pinter@uni-corvinus.hu, 30/999-6595